Margin loan on 401k

Interest rates vary depending on the amount being. Ad Help Secure Your Financial Future Through ABA Retirement Funds Retirement Plans.

Thinking About Cashing Out Your 401 K You Might Hav Ticker Tape

A margin loan from Fidelity is interest-bearing and can be used to gain access to funds for a variety of needs that cover both investment and non-investment needs.

. With the 100 additional shares you bought on margin your total portfolio is worth 6000 200 total shares times 30 price. Margin loans can also be a cost-effective way to access cash or liquidity often with interest rates lower than those for credit cards or unsecured loans. Compare Get Personal Loans Here.

Also margin interest may be tax. Get Your Loan In 24 Hours. The answer is still the same.

Borrowed funds secured by an asset are an acceptable source of funds for the down payment closing costs and reserves since borrowed funds secured by an asset. Fidelitys current base margin rate effective since July. Small business 401k plans with big benefits.

Im looking into different ways to fund deals and am curious about using my. Posted Nov 28 2020 1347. Ad Help Secure Your Financial Future Through ABA Retirement Funds Retirement Plans.

Yes even for margin accounts you have to pay a UBIT fee. The equity of a margin account is equal in simple cases to the accounts total value minus the outstanding margin loan and this equity must be kept at or above a margin maintenance level. 10575 1250 above base rate 625 rate available for debit balances over 1M.

Traditional or Rollover Your 401k Today. The problem with margin in IRAs is that the rules that give IRAs their tax advantages dont allow you to pledge the assets of your retirement account as collateral for a. Trading on margin by definition involves a loan says Ajay.

Collect the considerable rent while taking any allowable. Margin loans typically require a minimum of 2000 in cash or marginable securities and generally are limited to 50 of the investments value. A margin loan from Fidelity is interest-bearing and can be used to gain access to funds for a variety of needs that cover both investment and non-investment needs.

What if you have a Solo 401k plan and invest it in a margin account. If you decide to sell at this point you still have to pay back the. Penelope makes it simple.

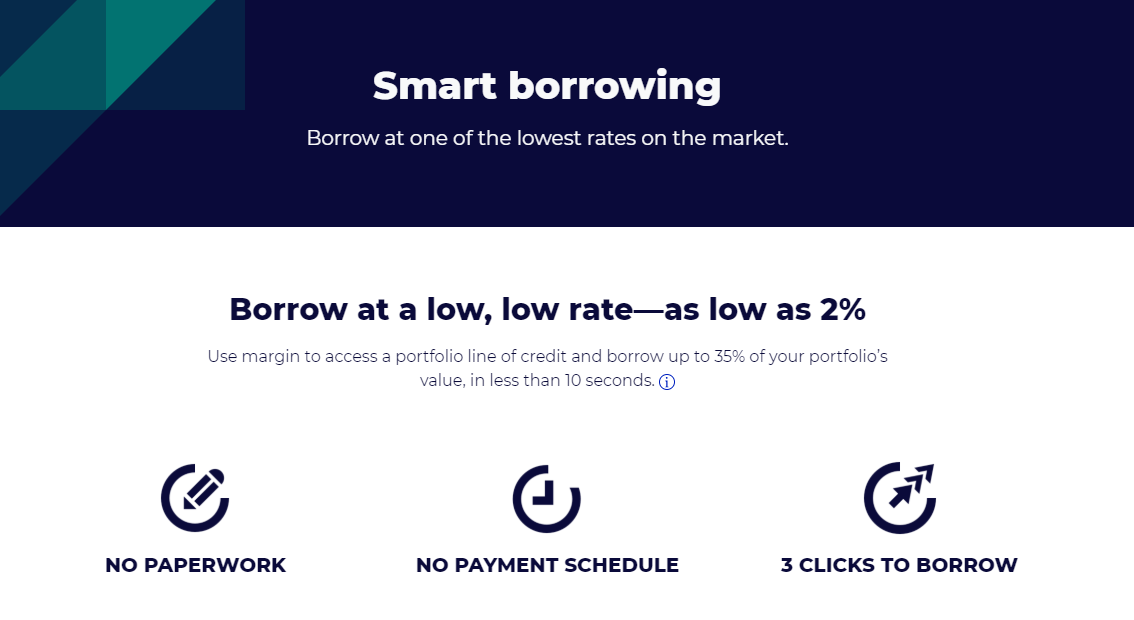

Theres no set repayment schedule with a margin loanmonthly interest charges accrue to your account and you can repay the principal at your convenience. In fact a tax court. Ad Attract and keep employees with 401k plans.

There are potential tax benefits with. Compare The Best Personal Loans for Bad Credit. 10075 0750 above base rate 024999.

Ad Make a Thoughtful Decision For Your Retirement. Legally you generally cant margin trade with an IRA because the IRS prohibits the use of IRA funds as collateral. Affordable easy payroll integrated.

Ad Need a Personal Loan but Have Bad Credit. Open an IRA Explore Roth vs. 401k IRA Margin Loans.

Margin loan interest may be tax deductible depending on your situation1 Consult your tax advisor to learn more. Should You Borrow From 401k To Pay Off Debt. Use a margin loan against these shares to buy a solid multi-unit apartment building preferably with a high yield and a.

Securities Based Lending Ameriprise Financial

Trading Faqs Margin Fidelity

Trading Faqs Margin Fidelity

Can I Earn Interest On Crypto Bitcoin In My Solo 401k Ira My Solo 401k Financial

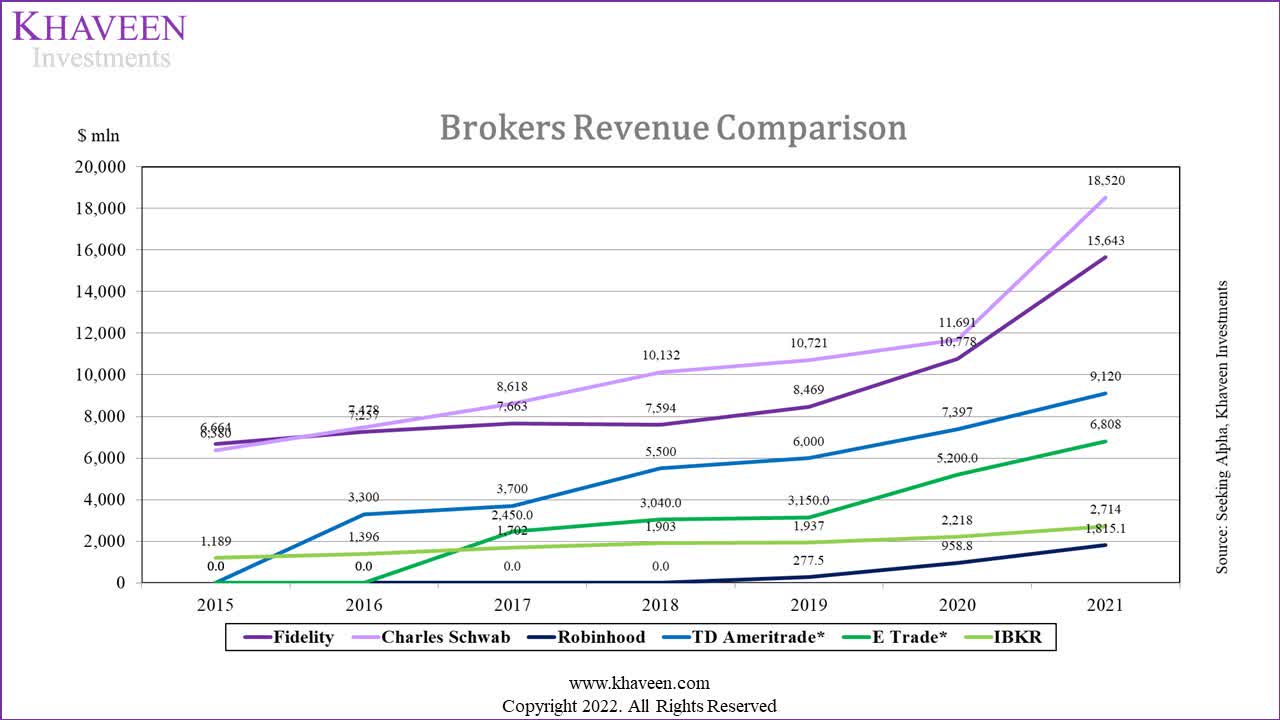

Interactive Brokers Stock Quality Business But Diluted Ownership Nasdaq Ibkr Seeking Alpha

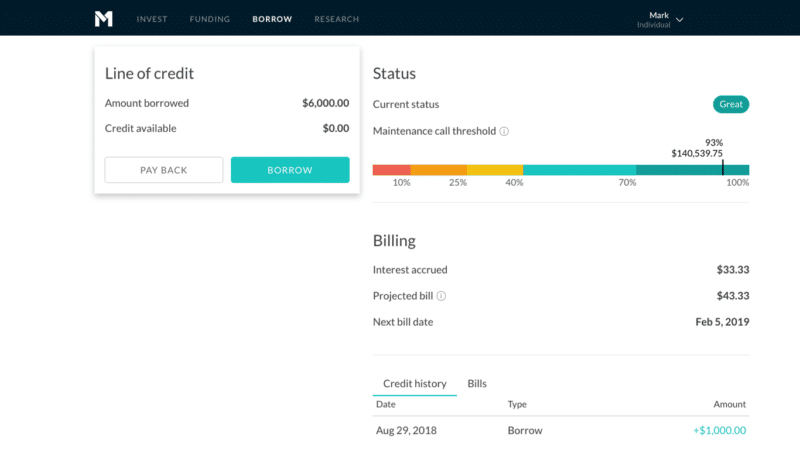

M1 Borrow Review Super Low Interest Margin Loans

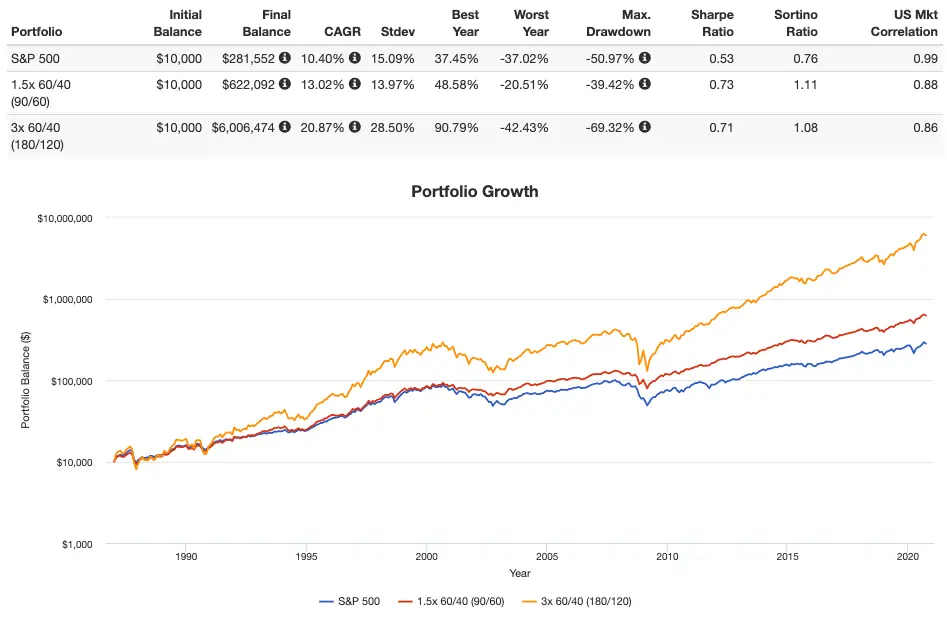

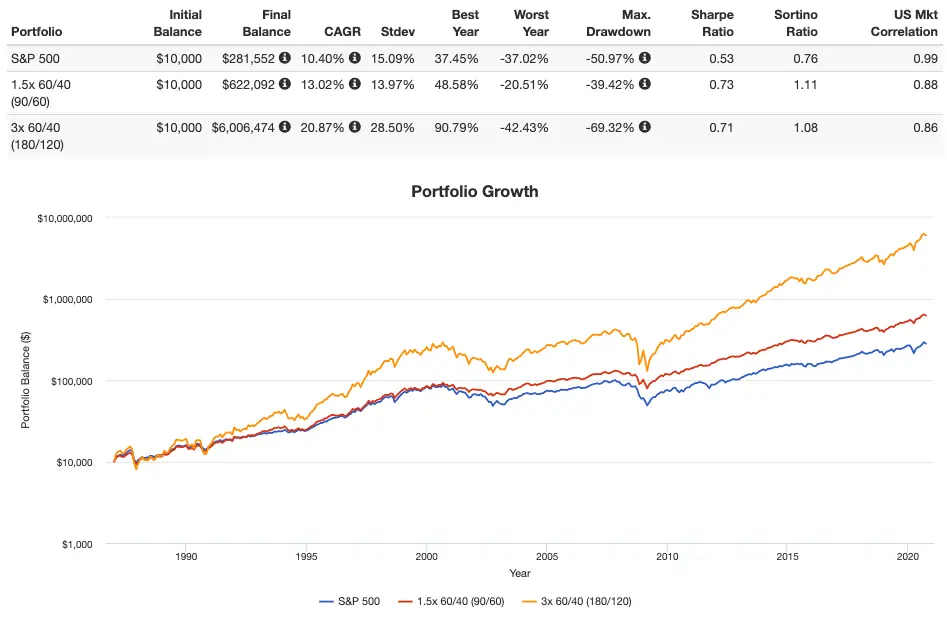

How To Beat The Market Using Leverage And Index Investing

How To Beat The Market Using Leverage And Index Investing

M1 Borrow Review Super Low Interest Margin Loans

Trading Faqs Margin Fidelity

M1 Borrow Review Super Low Interest Margin Loans

How To Beat The Market Using Leverage And Index Investing

What Is Buying On Margin Gobankingrates

401 K Guide What Is A 401 K Plan And How Does It Work

Trading Faqs Margin Fidelity

Is Margin Loan Interest Tax Deductible Seeking Alpha

M1 Borrow Review Super Low Interest Margin Loans